Loss aversion and prospect theory

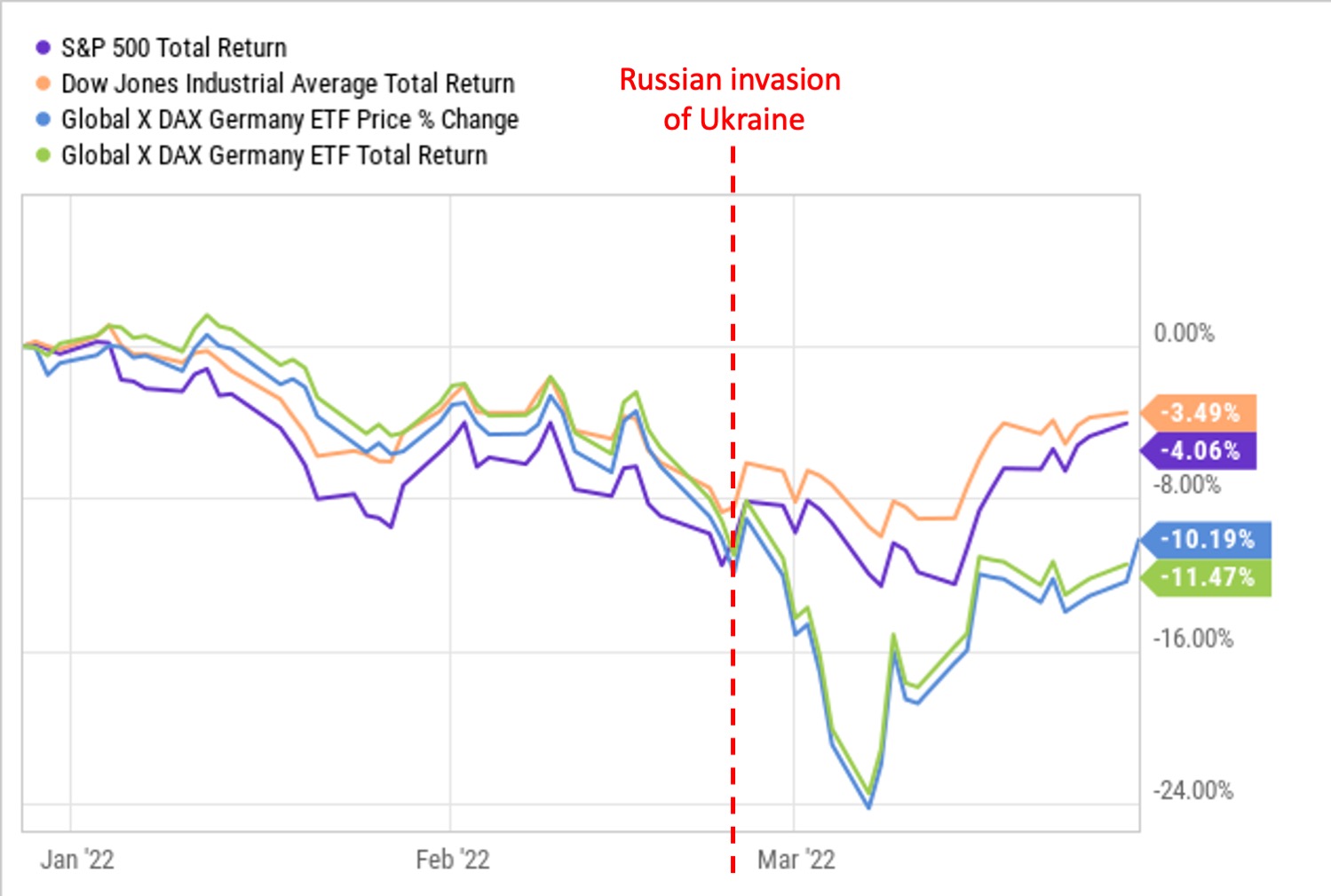

During the weeks leading up to and following Russia’s invasion of Ukraine on Feb. 24, 2022, stock markets plummeted. Concerned about geopolitical uncertainty, rising energy costs, and inflation, some investors sold off stocks, effectively locking in their losses and missing out on potential gains that will occur once the market rebounds, which as of this writing, has already begun. Why? One potential explanation is loss aversion.

The stock market downturn before and after the Russian invasion of Ukraine caused some investors to panic and sell prematurely.

Loss aversion is our tendency to avoid losses more than achieve gains that are equivalent in value. It is a cognitive bias that can cause investors to overly avoid risk, choosing portfolios that do not deliver the returns they need for their financial goals as well as sell during stock market downturn like we recently saw. It can also lead to investors holding on to losing portfolios for too long to avoid realizing those losses.

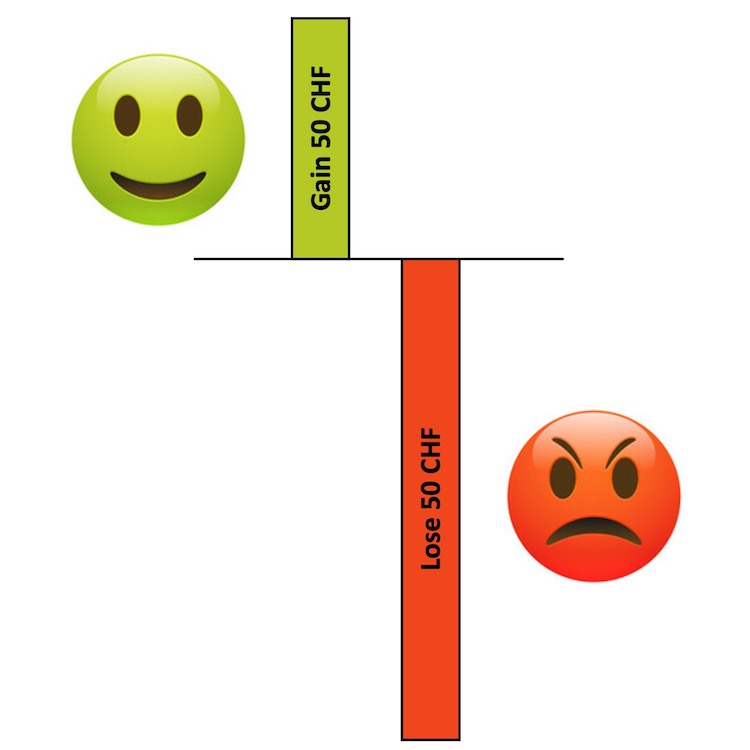

The psychological basis of loss aversion is easy to grasp. We enjoy winning things, and we don’t like losing things. However, we don’t like losing things more than we enjoy winning things of similar value. In fact, we feel the pain of losing about twice as much as the joy of winning[1], according to Daniel Kahneman, who alliteratively wrote “losses loom larger than gains” in his seminal paper on prospect theory with Amos Tversky[2].

Loss aversion. The pain we feel after losses is about twice as powerful as the joy we feel after gains of equivalent value.

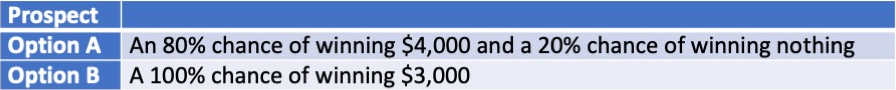

Here are typical gambles (or prospects) that were offered to participants in Kahneman and Tversky’s studies:

Which one would you choose? If you chose option B, then you’re with the majority, as 80% preferred to play it safe with a sure bet. Even when participants were explicitly told that the expected value of option A is $3,200, which is $200 more than option B, they still selected option B.

Which one would you choose? If you chose option B, then you’re with the majority, as 80% preferred to play it safe with a sure bet. Even when participants were explicitly told that the expected value of option A is $3,200, which is $200 more than option B, they still selected option B.

Now look at this set of options:

Which one would you choose now? This time 92% of participants chose option C.

Which one would you choose now? This time 92% of participants chose option C.

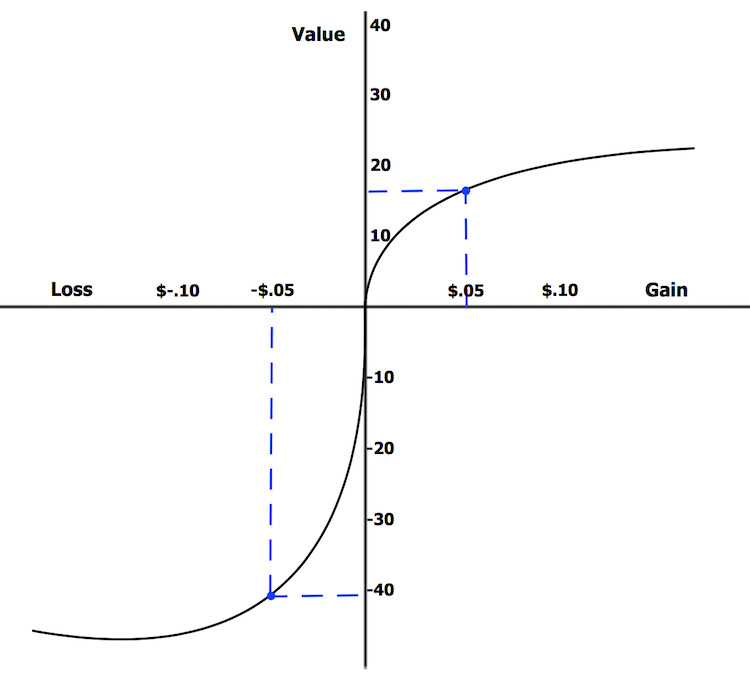

From choices such as these, we can understand that people prefer to have a sure gain over a gamble for a larger gain, but they will take risks (or behave dishonestly[3]) to avoid a sure loss. This means people actually make choices that would on average lead to smaller gains and larger losses. Kahneman and Tversky’s prospect theory captures these preferences with an asymmetrical value function that passes through a reference point[4]:

The value function is steeper for losses, indicating that they have a stronger impact[4].

Loss aversion affects many areas of decision-making

Loss aversion does not only affect investments or other monetary gambles. This cognitive bias can affect decisions ranging from politics and social policy (think of different decisions made during war time vs. peace) to daily life (think of how you react to praise compared to criticism or even how frequently you save an important document).

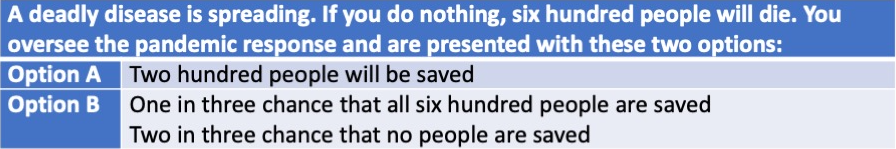

Kahneman and Tversky also examined people’s reactions to emotional stimuli. Here is another set of choices they offered to participants:

How would you respond? For this set of options, 72% participants chose option A to guarantee that two hundred lives will be saved.

How would you respond? For this set of options, 72% participants chose option A to guarantee that two hundred lives will be saved.

With this set of options, 78% chose option D to gamble so that no one has to die. Of course, if you take a closer look, both sets of options are exactly the same. The difference is in how the options were framed for participants in terms of gains or losses, and this framing has a dramatic influence on choice.

With this set of options, 78% chose option D to gamble so that no one has to die. Of course, if you take a closer look, both sets of options are exactly the same. The difference is in how the options were framed for participants in terms of gains or losses, and this framing has a dramatic influence on choice.

But why?

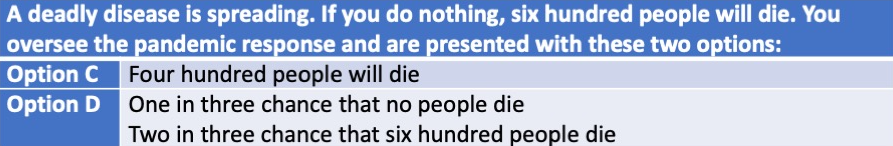

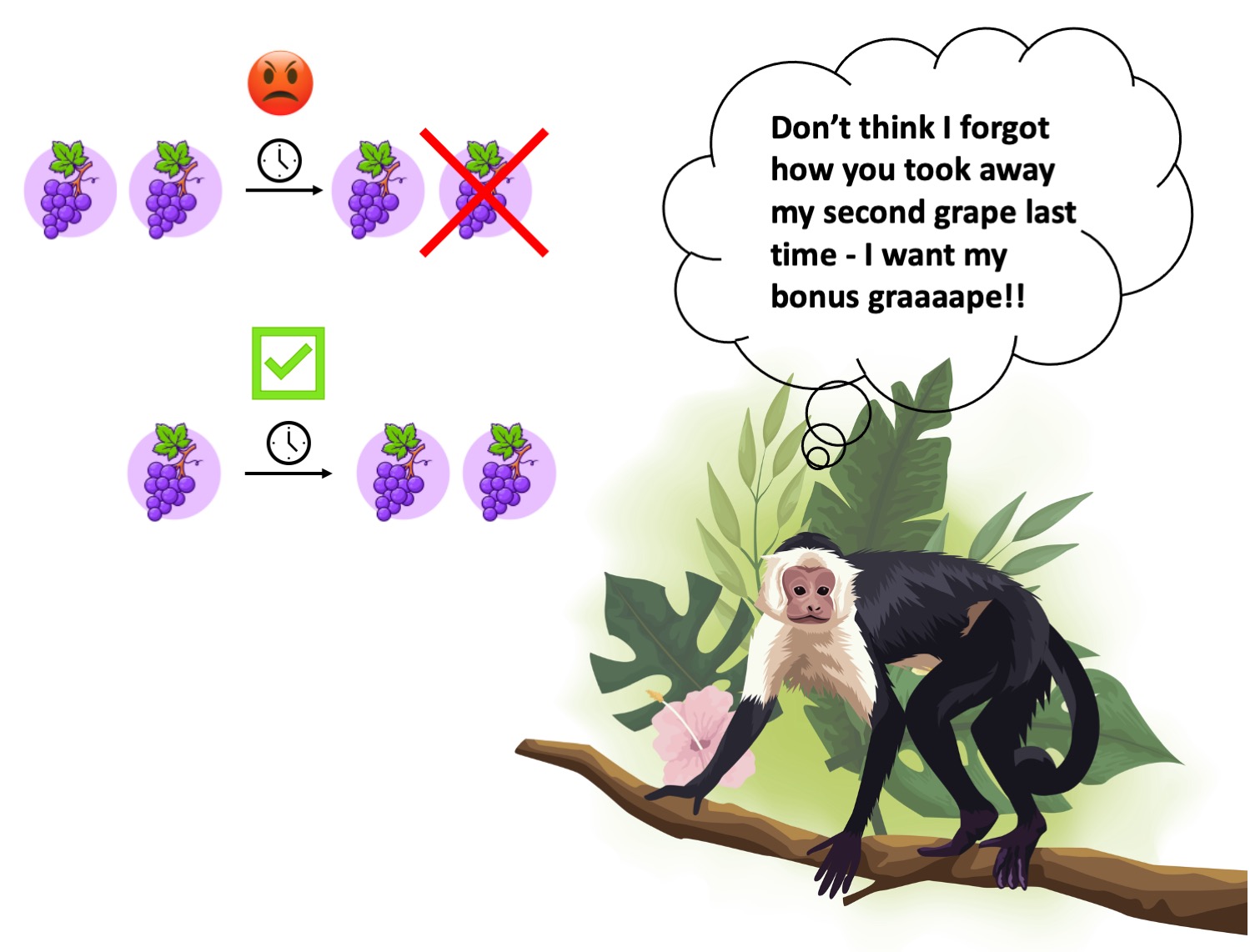

A 2006 study found loss aversion-like behavior in Capuchin monkeys[5]. This suggested that loss aversion is innate - that is, it is an ancient feature of human preferences rather than a learned behavior.

In the study the monkeys played two games. In the first game, the monkeys were presented a single grape, and based on a coin toss, they were sometimes awarded a “bonus” grape. In the second game, the monkeys were presented with two grapes. When the coin was tossed, one grape was sometimes taken away, and the monkey received the other. On average, the outcomes of both games were the same – the monkey got one grape. However, the monkeys preferred to play the first game, where they could gain a grape, much more than the second game, where a grape could be lost.

Unfortunately, a follow-up study called into question this loss aversion-like behavior, as it is well-known from similar games that monkeys favor options where they see more food at first regardless of the eventual outcome, which they aren’t able to learn[6]. It is notoriously difficult to carry out loss aversion experiments with animals, as of course the probabilities of the gambles cannot be communicated to them, preventing tests with a variety of choices. Instead, animals must learn the probabilities underlying a gamble by repeatedly playing it.

Still, loss aversion may have an ancient explanation. For our ancestors who survived the harsh elements of the Stone Age and lived on the edge of existence, avoiding losses would have been key to preventing extinction, whereas an equivalent gain may not have ensured survival.

Capuchin monkeys prefer a game where they are shown one grape and occasionally receive a bonus grape over a game where they are shown two grapes and occasionally one grape is taken away. Are they loss averse too?

Does loss aversion play a role in all circumstances?

While loss aversion can apply to many domains, to say that it is a psychological principle that we can rely on in all circumstances is an oversimplification.

For example, let’s say you’re playing your friend in a game of table tennis, and they bet you 10 CHF that you will lose. You play and wind up losing the 10 CHF. Your friend then challenges you to double or nothing to get your 10 CHF back. Loss aversion may motivate you to play again to avoid realizing the 10 CHF loss. However, then your friend wins again, and you lose 20 CHF in total to them. The next day your friend challenges you again to another game for 10 CHF. You are feeling good, so you play them again and lose. This time, they may challenge you to double or nothing, but you are less likely to accept based on loss aversion because you’ve learned better. Your friend is just really good.

Similarly, other studies have shown that we’re not loss averse for all types of financial wagers[7], and other real-world behaviors - such as overtrading and lack of diversification - can be seen as evidence against loss aversion.

Leveraging loss aversion

Choices can be framed based on the loss domain to steer decisions. We see appeals to people’s loss aversion everywhere such as messages that a sale will end soon or that it’s the last chance to buy a product before it’s gone forever. For customers who buy cars, they will spend more when they are presented with a fully-loaded model and asked to subtract features compared to when they are presented with a base model and asked to add features[8].

Game designers also either use or avoid loss aversion depending on whether they want to terrify players or provide them with a more comfortable playing experience. In the role-playing game Dungeons and Dragons, undead creatures are made especially frightening because they can drain down the level a player’s character has reached in game from having accumulated experience points (XP). Many players feel they would rather die than see their characters lose 50% XP.

These and other examples show us that when we frame choices appropriately, fear of loss can be a powerful motivator for people to take action.

Get in touch

Find out more about how Collabree’s solution leverages loss aversion and other biases by contacting us here:

Dr. Anjali Raja Beharelle

CSO – Collabree AG

[email protected]

Pascal Kurz

CEO – Collabree AG

[email protected]

Literature

[1]: Kahneman, D. & Tversky, A. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty. 5 (4): 297–323. (1992). doi:10.1007/BF00122574.

[2]: Kahneman, D. & Tversky, A. “Prospect Theory: An Analysis of Decision under Risk. Econometrica. 47 (4): 263–291 (1979). doi:10.2307/1914185. JSTOR 1914185.

[3]: Schindler, S., & Pfattheicher, S. The frame of the game: Loss-framing increases dishonest behavior. Journal of Experimental Social Psychology, 69, 172–177. (2017) https://doi.org/10.1016/j.jesp.2016.09.009

[4]: By Laurenrosenberger - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=67117183

[5]: Chen M.K, Lakshminarayanan V, Santos L.R. How basic are behavioral biases? Evidence from capuchin monkey trading behavior. Journal of Political Economy.(2006);114:517–537

[6]: Silberberg, Alan et al. On loss aversion in capuchin monkeys. Journal of the experimental analysis of behavior, 89, 2 (2008): 145-55. doi:10.1901/jeab.2008.89-145

[7]: Ert, E., & Erev, I. On the descriptive value of loss aversion in decisions under risk: Six clarifications. Judgment and Decision Making, 8(3), (2013) 214–235.

[8]: Park, C., Jun, S., & Macinnis, J. Choosing what I want versus rejecting what I do not want: An application of decision framing to product option choice decisions. Journal of Marketing Research, 37(2), 187-202. (2000).